Great Canadian Gaming Corporation [TSX:GC] ('Great Canadian' or 'the Company') has announced its financial results for the three-month period ended June 30, 2013 ('second quarter 2013').

SECOND QUARTER 2013 HIGHLIGHTS

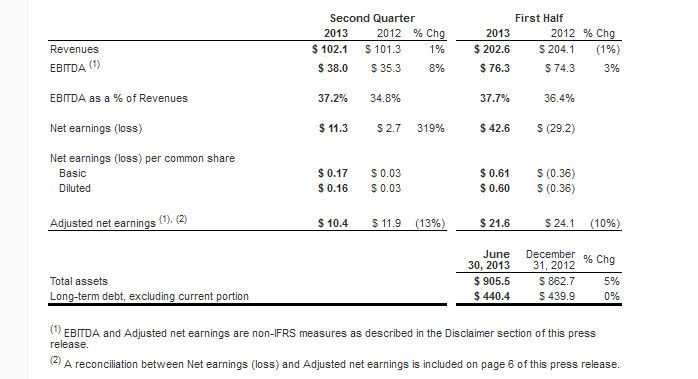

(Amounts presented in millions of Canadian dollars, except for per share information)

- Revenues of $102.1 million in the second quarter, a 1% increase when compared to the prior year

- EBITDA(1) of $38.0 million, an 8% increase when compared to the prior year

- Net earnings of $11.3 million, compared to $2.7 million in the prior year

- Adjusted net earnings(2) of $10.4 million, compared to $11.9 million in the prior year

- Subsequent to the conclusion of the quarter, announced upcoming re-launch of the Boulevard Casino as the Hard Rock Casino Vancouver

For the second quarter of 2013, Great Canadian recorded revenues of $102.1 million, a $0.8 million, or 1%, increase from the second quarter of 2012. EBITDA was $38.0 million, a $2.7 million, or 8%, increase from the second quarter of 2012. The increases in consolidated revenues and EBITDA were primarily due to revenue growth at the River Rock Casino Resort ('River Rock') and the recently opened Chances Chilliwack, as well as improvements at Great American Casinos. These increases were substantially offset by declines at both the Boulevard Casino ("Boulevard") and the Company`s Ontario Racetracks. EBITDA as a percentage of revenues for the second quarter of 2013 was 37.2%, a 2.4 percentage point increase from the second quarter of 2012.

Net earnings increased by $8.6 million in the second quarter of 2013, when compared to the second quarter of 2012. This increase was primarily due to a non-recurring expense of $11.0 million associated with the settlement of a legal dispute in the second quarter of 2012. Net earnings were also impacted by both the increased EBITDA and a reduction in amortization expense. These increases were partially offset by both higher net interest and financing costs due to a higher amount of long-term debt, as well as an increase in income taxes that related to the higher earnings before income taxes in the second quarter of 2013, when compared to the second quarter of 2012.

"Great Canadian's financial results for the second quarter of 2013 reflect positive contributions from River Rock, our recently opened Chances Chilliwack, and the Great American Casinos," stated Rod Baker, Great Canadian's President and Chief Executive Officer. "Despite these encouraging performances, our Boulevard casino once again witnessed declines in slot coin-in, table drop, and food and beverage revenues. Boulevard remains challenged by both local economic conditions and ongoing disruption caused by proximate highway construction.

"We continue to focus upon providing Boulevard's loyal guests with exceptional service as we work towards the re-launch of the property under the Hard Rock Casino Vancouver brand later this year. The introduction of this exciting brand, which we announced at the beginning of July, will coincide with the conclusion of the nearby highway construction.

"Since April 1, 2013, Great Canadian's Ontario racetracks have operated under interim lease arrangements with the Ontario Lottery and Gaming Corporation. Despite the receipt of both lease revenues from the OLG and horse racing transition funding from the Government of Ontario, there was an overall decline in revenues at these two facilities, which no longer receive a fixed percentage of the OLG's slot revenues nor directly share in the horse racing pari-mutuel wagering revenues that the tracks generate. We are pleased to continue our relationship with the OLG, and look forward to developing this relationship further as the gaming industry in Ontario continues its evolution.

"Great Canadian is financially prepared to take advantage of new value-added growth opportunities, including those in Ontario. The Company's financial flexibility is evident in both our strong cash balance and our undrawn revolving credit facility. While we await greater clarity surrounding these opportunities, we continue to pursue other avenues for the creation of shareholder value. The Company devoted $6.9 million of its cash resources during March 2013 and $16.6 million during April 2013 toward repurchasing and cancelling 2.5 million common shares at an average price of $9.32. As a result of these cancellations, we increased the ownership percentage of our existing shareholders by 3.6%."

To view a copy of the complete release from Great Canadian, click here.

(With files from Great Canadian)